A Guide on Your Business Tax Rates

Andrew Jeffers | April 11, 2018

Are you about to start your own business?

Do you know the business tax rates that apply to each of company structures out there: sole trader, trust, company, partnership?

Today we’ll get a bit technical. I’ll explain how to choose your business structure, depending on company types.

Let’s get into it!

Sole trader

When you’re starting your business as a sole trader, the tax applies to you as an individual.

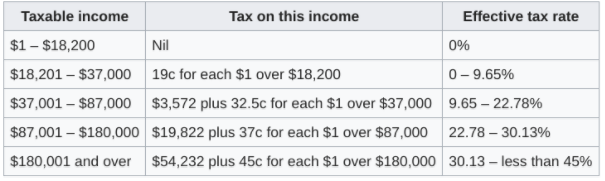

In Australia, we are on a marginal tax system, which means:

from $1-$18,200 it’s $0 tax

from $18,201-$37,000 it’s 0-9.65% tax

from $37,001-$87,000 it’s 9.65-22.78% tax

from $87,001-$180,000 it’s 22.78-30.13% tax

from $180,001 and over it’s 30.13-less than 45%

The above rates do not include:

The Medicare levy of 2% (legislation pending to increase this to 2.5%).[9]

The low income levy, which effectively increases the tax free threshold to $20,543.

Therefore, when you, as a business or sole trader, earn over $180k, you get taxed at the top margin of the tax rate.

Tip: When you are starting a business, you need adequate planning and preparation.

You might also be interested in: 4 Things You Need To Understand Before Starting A Business

Company

There are a few tax differences between a sole trader and a company. A company is taxed at a flat rate.

If you are a small business, you get taxed at 27.5% of your income.

That money can stay in the company and only be taxed that amount. You’re taxed extra if you start to take the money out as an employee or as a director.

Tip: As a sole trader you get taxed the individual rates listed earlier, but a company is taxed at a flat rate.

If you start a company and you’re wondering if you’ll get double taxed when it comes to bonuses, directors’ fees, wages or even through dividends, here’s your answer...

We live in a country that doesn’t allow double taxation.

If your company is taxed the flat rate of 27.5% and then you pay yourself some dividends on a higher tax rate, you only have to pay the difference.

If, in the situation that you pay yourself a low income one year, the company pays 27.5% tax and your personal tax rate will be only around 20%, then you should get a refund.

You might also be interested in: Why Is It Important To Choose Your Business Structure Wisely?

Keep in mind

Choosing the right business structure for your company is going to help you tremendously in the long run. There are a lot of tax implications when it comes to business tax rates and choosing the right structure for your business is one of the keys to steady growth and success.

The best way to move forward is to make sure you get proper advice from a financial expert. At Shuriken Consulting, we can give you a hand with that.

Get in touch with us by clicking the contact button down below and let’s get into those taxes together!